Summary

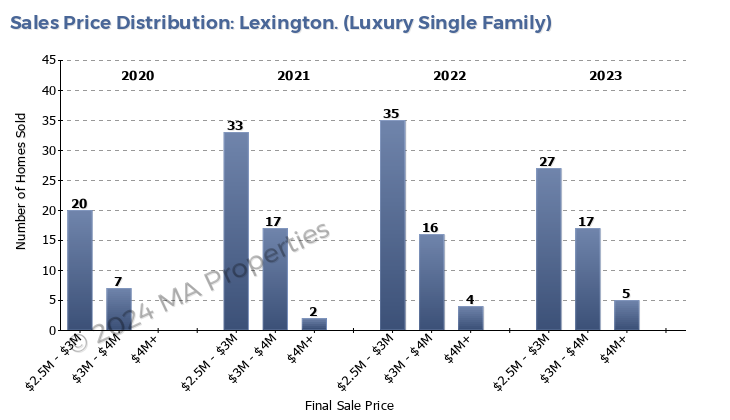

Consistent with the 2022/2023 Market Review we define the defined the luxury market as homes which sold for $2.5 million or above.

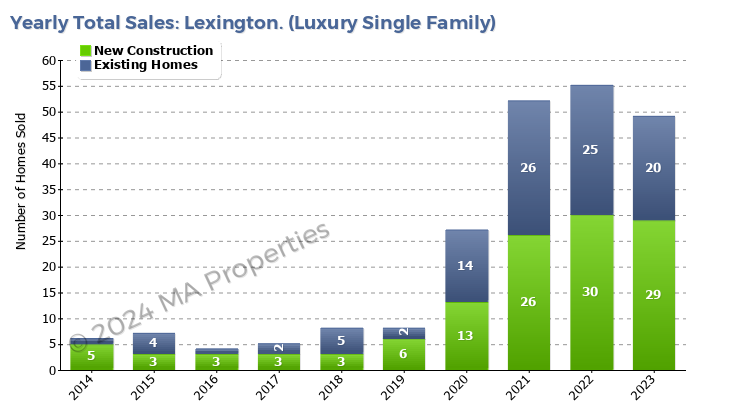

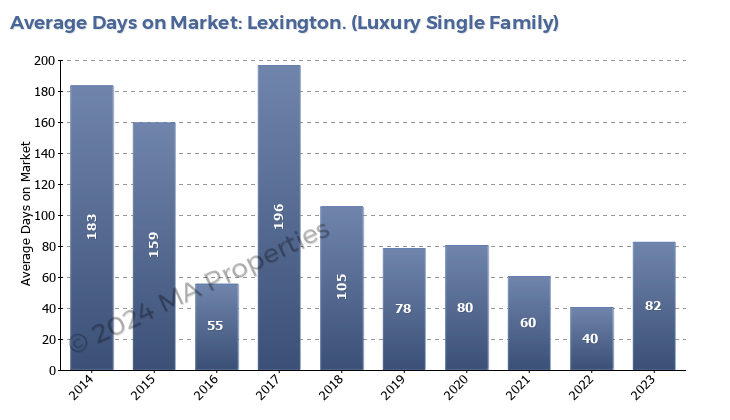

In recent years, the luxury market in Lexington has been very strong. This is shown by the key performance metrics Days on Market and Sale Price to List Price Ratio strengthening, and by an increase in the number of homes sold. In 2023 these performance metrics declined, consistent with the overall weaker housing market. Given the large number of new construction homes in the over $2.5 million price range and the oversupply of these homes listed in 2023 the Days on Market and Sales Price to List Price Ratios declined markedly. The number of homes sold in the luxury market in 2023 was 49 compared to 55 in 2022 – an 11% decrease. This should be viewed against the overall housing market that saw a 13% reduction in the number of home sales.

Many sellers of existing homes worry about the impact of new construction on the luxury market. The primary impact of these new homes is that buyers of existing homes will expect a similar quality to new construction. Given the characteristics of the luxury market and the new construction component of it, it’s important to focus on the fundamentals – home preparation, great staging, a comprehensive marketing plan, and the right pricing strategy are key to having buyers consider an existing home versus new construction and obtaining the maximum price for your home.

.