Summary

In many respects 2024 was a “rinse and repeat” of 2023. 2024 was impacted by rising mortgage interest rates – this caused sellers to postpone selling and buyers to pull back as they saw rates rise between getting a pre-approval and getting an accepted offer on a home. In some instances, this increase in borrowing costs caused buyers to exit contracts as repayment costs became simply too high.

Looking back at our 2023/2024 Market Review our two key predictions for 2024 were firstly the return to the normal cycle of downsizing, move-up, and relocating sellers would continue with a similar number of homes sales as we saw in 2023, and secondly, there would be some hesitancy with buyers with mortgage rates still over 6% and uncertainty over the medium-term market condition and price appreciation. This hesitancy would subside as mortgage interest rates decline as the year unfolded.

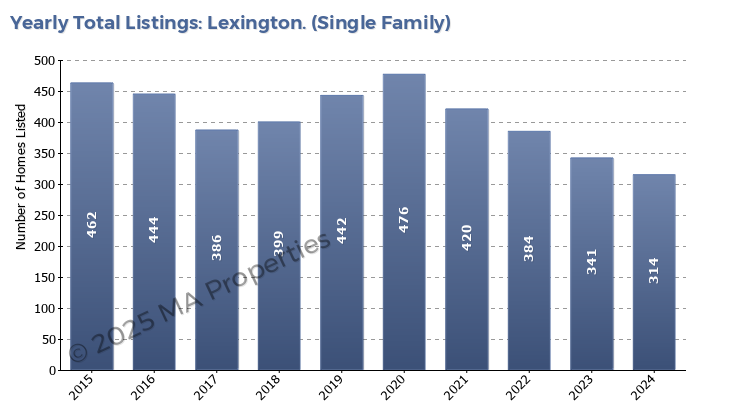

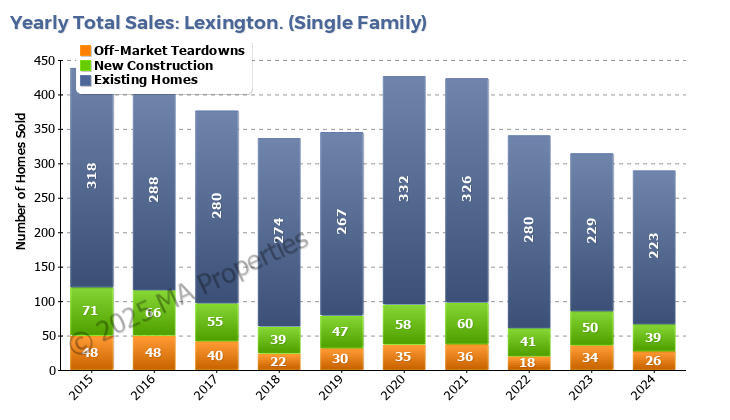

The continued high interest rates negatively impacted both predictions. The total number of homes sales in 2024 was lower than in 2023 as sellers postponed selling to avoid a large increase in their monthly mortgage repayments. The second prediction hinged on reduced interest rates as 2024 unfolded. Whilst interest rates declined slightly in Q3 they rose again in Q4 and as we write this in January 2025, they are now over 7%.

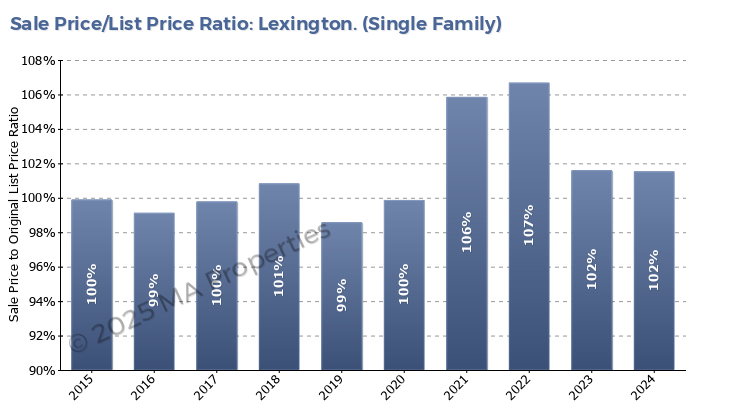

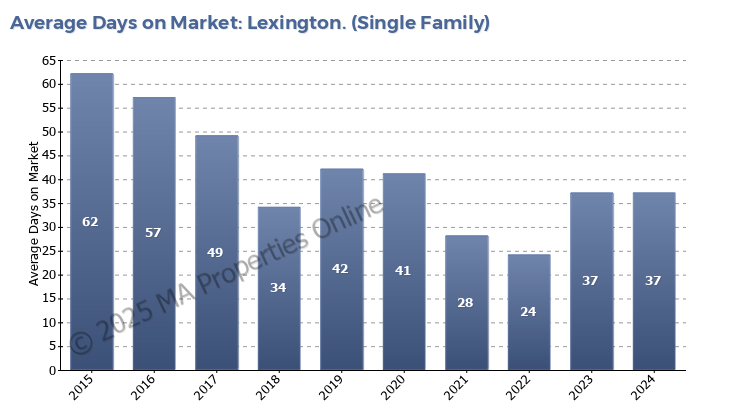

Given these characteristics many of the key performance metrics – days on the market and sale price/list price ratio - showed a relatively weak market in 2024. But closer examination shows a noticeable decline in these metrics as the second half of the year unfolded and the prospects of a substantial mortgage rate reduction declined. The sale price/list price ratio peaked at 106% in May and was at 102% for the full year, but it was at about 100% each month throughout the second half of the year.

How should we view these numbers? Home sales were lower than anticipated and are now lower than 2018/2019 levels (the last “normal” years prior to COVID). A 100% sales price/list price ratio was the value seen through each year from 2013-2020 and the 2024 value of 102% is a consequence of very limited inventory for buyers, able and willing to enter the housing market, having to bid house prices higher. Days on the market were consistent throughout the year at about 37 days (2023 value was also 37 days). And so, if we view these against the gloom and doom of the national real estate market it’s clear that the Lexington market weathered the market turmoil caused by the rapid rise in interest rates well. Proving that the adage ‘Real Estate is local’ is accurate.

As we look forward, what will 2025 bring? Mortgage interest rates are predicted to move slightly lower with currently 6.1% predicted for the end of 2025. But we’ve heard this story before and with such uncertainty in the overall economy we anticipate very similar real estate market conditions in 2025 as we saw in 2024. Any sign of more sellers, less hesitant buyers, and the stable market condition seen prior to the COVID years of 2020 and 2021 will have to wait until at least 2026.