New Construction Home Sales

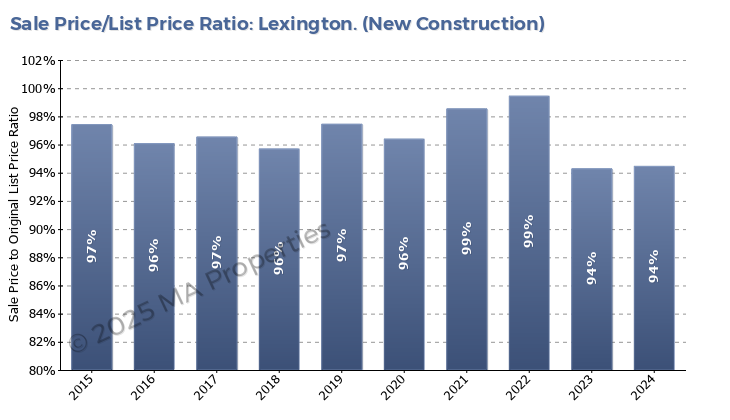

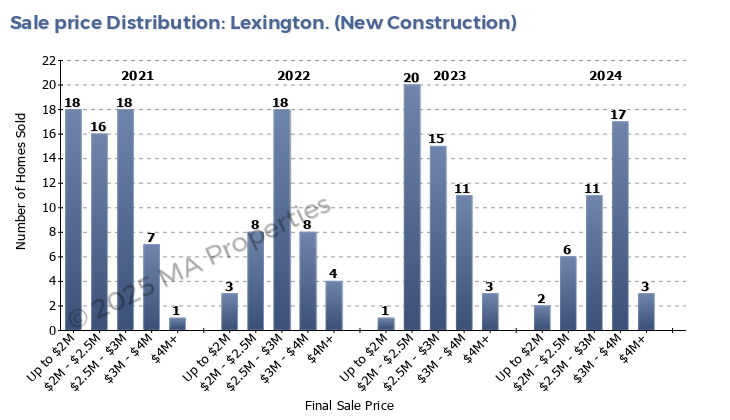

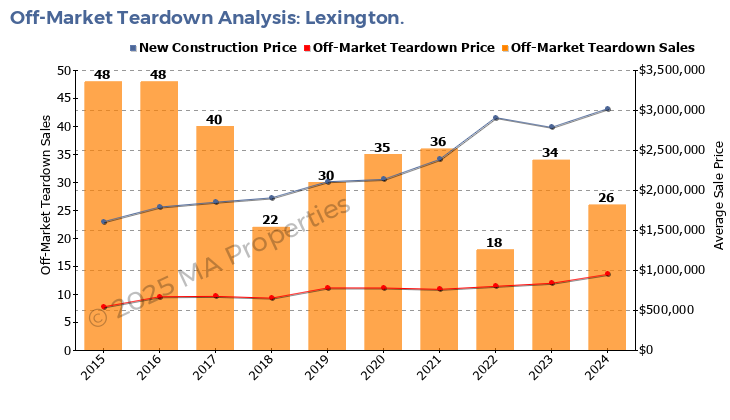

We saw a decrease in the number of new construction homes sold in 2024 to 39 homes (50 new construction homes sold in 2023 and 41 new construction homes sold in 2022). The reason for this increase in 2023 was that many new construction homes built in 2022 remained unsold at the end of the year. In 2023, developers were forced to discount those homes and so the average price of new construction homes declined in 2023, the sale price to list price ratio decreased to below 100% and days on the market doubled to 80 days. This over-capacity was almost completely absorbed in 2024 and so in 2024 home sales returned to the numbers seen in 2022. But the high carrying costs faced by developers meant that in 2024 new construction homes sold quicker than in prior years but with a lower sale price to sale price ratio (with developers discounting from the list price to sell quickly).

As we write this (January 2025) there are a total of 17 homes on the market, 10 (60%) of these are new construction. Also, all 10 of these new construction homes are over $2.5 million. With 7 new construction homes cancelled in the last 3 months of 2024, a new set of homes coming on in 2025, and continued high carrying costs we predict that developers will continue to discount prices as 2025 unfolds.