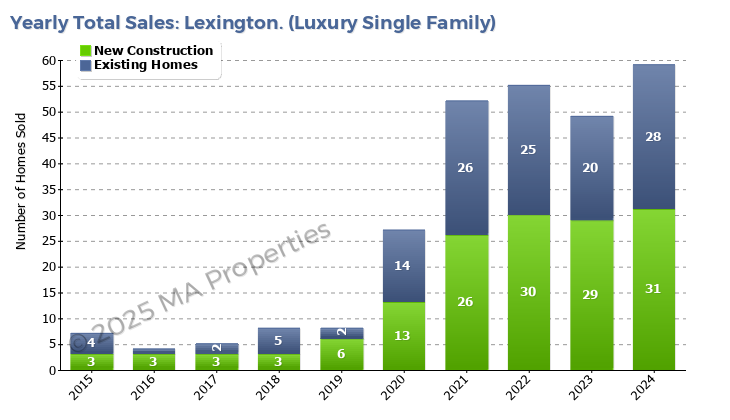

Luxury Home Sales

The number of homes sold in the luxury market sector in 2024 was 59 compared to 49 in 2023 and 55 in 2022. As noted above, this increase in luxury home sales in the two-year period from 2022 to 2024 was 7%. But this data should be viewed against the overall Lexington housing market that saw an 18% reduction in the number of home sales in the same two-year period between 2022 and 2024.

The luxury market in Lexington mirrored the overall luxury housing market in Massachusetts with fewer luxury home sales in 2023 and a return to 2022 levels, or higher, in 2024. In 2022 there were 937 luxury homes sold in Massachusetts. In 2023 only 741 luxury homes were sold. In 2024 there were 951 luxury homes sold in Massachusetts. This is only a 1.5% increase for the two years between 2022 and 2024 compared to a 7% increase in Lexington over the same period.