Summary

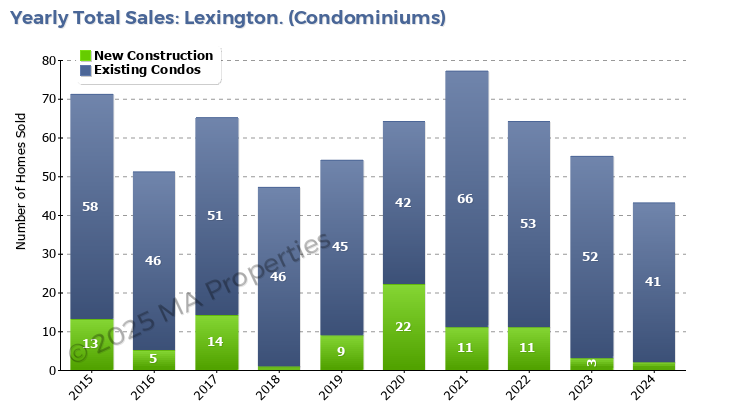

The condominium market is small when compared to the single-family home market with 43 condominiums selling in 2024 compared to 262 single family homes. There are few standalone condominiums (for example in 2 or 3 family dwellings) in Lexington. Both existing and new construction condominiums tend to be grouped into “communities” that offer many shared services. Providing these services typically raises the condominium fees.

Average condo association fees in 2024 were $568/month. If we compare these fees with Arlington, which had 180 condominium sales in 2024, primarily 2/3 family homes, the average condo association fee was $279/month, we can begin to see why even with a lower average sale price the Lexington condominium market has been considerably weaker than the single-family home market.

The biggest issue facing existing condominium owners is the large number of new construction condominiums being planned within the Village and Multi-Family zoning districts defined to comply with the MBTA Communities state legislation. The exact number and completion dates of these new condominiums is still unknown as many projects are proposed but pending approval and the towns response to the MBTA legislation is subject to a citizen’s petition. But it is very likely that Lexington will see hundreds of additional condominiums being built within the next 5 years.

In addition, a large number of “condominium style” rental units are either approved (512 units on 331 Concord Ave and 17 Hartwell Ave) or proposed (430 units on 3,4,5 Militia Drive and 7 Hartwell Ave). It is very likely we will see over 1,000 additional rental units (the existing Avalon communities comprise 585 units) being built within the next 5 years. These additional units will put downward pressure on both condominium prices and rental returns in the medium/long term.