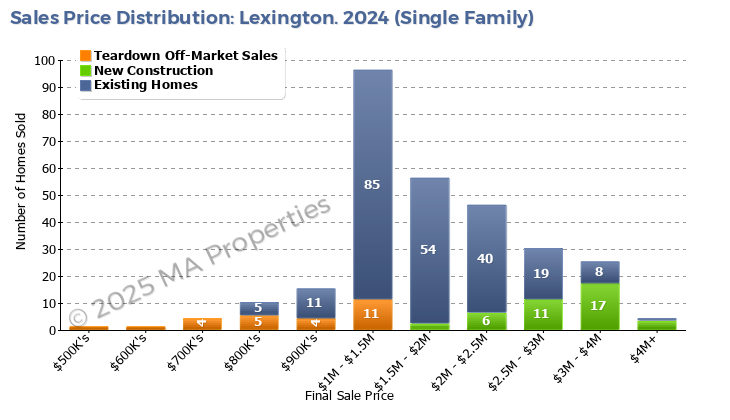

Single Family Homes Sales Price Distribution

In 2024, single family homes sold in the Lexington market consisted of new construction (13%), off-market teardowns (10%) and existing homes (77%).

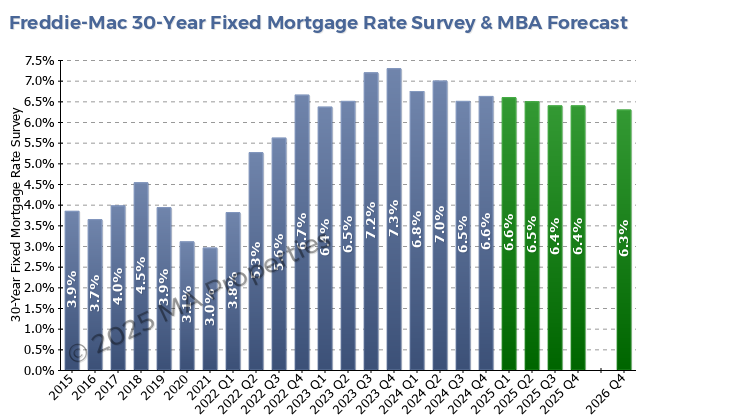

The 2023 and 2024 Lexington housing market was dominated by high mortgage interest rates.

Both the 2023 and 2024 predictions for a declining mortgage interest rate were wide of the mark with the rate at the end of 2024 at over 7% compared to the prediction, 12-months earlier, of below 6%. As we write this in January 2025 the current interest rate is 7.04% with the prediction for the end of 2024 only 1% lower at 6.1%.

Given this fact it seems very likely that more sellers, less hesitant buyers and the stable market condition seen prior to the COVID years of 2020 and 2021, will have to wait until at least 2026.

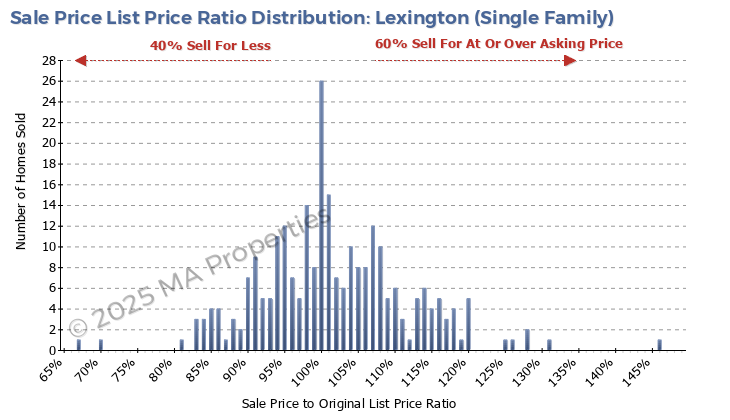

The continued high mortgage interest rates have put the brakes on the housing market for both buyers (unable to afford the monthly payments) but also for sellers (reluctant to take on a new mortgage 3-4% higher than their current one). The overall effect is a decrease in the number of homes both listed and sold to levels not seen since the housing crash in the mid-2000’s. The low inventory meant that buyers able and willing to enter the housing market still had to compete for homes though, with the average sale price to list price ratio at 102% for both single-family homes and condominiums.

While we saw a rise in the price of new construction homes in 2024, the average sale price to list price ratio was 94% (a similar value to 2023) as developers were forced to sell homes quickly (days on the market declined to 39 days) but at a discount to the list price to minimize carrying costs.

One major issue facing existing condominium owners is the large number of new construction condominiums being planned within the Village and Multi-Family zoning districts. The exact number and completion dates of these new condominiums is still unknown as many projects are proposed but pending approval and the towns response to the MBTA legislation is subject to a citizen’s petition. But it is very likely that Lexington will see hundreds of additional condominiums being built within the next 5 years.

For landlords and condominium owners the large number of “condominium style” rental units either approved (512 units on 331 Concord Ave and 17 Hartwell Ave) or proposed (430 units on 3,4,5 Militia Drive and 7 Hartwell Ave) is a major concern. It is very likely we will see over 1,000 additional rental units (the existing Avalon communities comprise 585 units) being built within the next 5 years. This will put downward pressure on both condominium prices and rental returns in the medium/long term.

Turning our focus to 2025 and beyond we predict the following:

In 2024, single family homes sold in the Lexington market consisted of new construction (13%), off-market teardowns (10%) and existing homes (77%).

The major demographic changes we are seeing are an increase in the number of Millennials entering the housing market for the first time and an increase in the number of downsizers as the baby boomers reach retirement age. In 2020 and 2021 these demographic shifts were overshadowed by changing housing requirements as buyers reacted to the new normal of, for example, hybrid work models. 2022 saw a return to the pre-COVID environment with homes sales declining to the 2018/2019 levels.

Having stated, along with major mortgage analysts, for the last few years that mortgage rates are anticipated to remain at a low level, 2022 broke this trend with rates rising rapidly in mid-2022 and this trend continued into 2024. All indications are that it will continue at these elevated levels throughout 2025 and into 2026.

As we have noted many times in this review these high interest rates have put the brakes on the housing market, and it seems very likely this will continue until 2026.

The real estate market outlook in Lexington is relatively positive with many homes selling with competing offers and selling for at, or above, the asking price. Why then in the moderately strong sellers’ market seen in 2024 did 40% of homes sell for less than the asking price? The answer lies with three factors – the presentation, marketing, and pricing strategy in selling the home. Buyers are highly educated about home values and listing a home at too high a price is a clear red flag to buyers, who then ignore the home until the price drops below market value. A focus on the fundamentals is critical to attain a sale price equal to, or over, the asking price when selling a home in 2025 and beyond. The fundamentals include preparing the home to be move-in ready, presentation of the home including staging, marketing the home including all digital aspects of video, photos, floor-plans, 3D tours and multi-channel advertising campaigns, and realistic pricing are critical.