Platform

Home > Communities > Arlington > Arlington Market Review > Single Family Home Market Summary

Summary

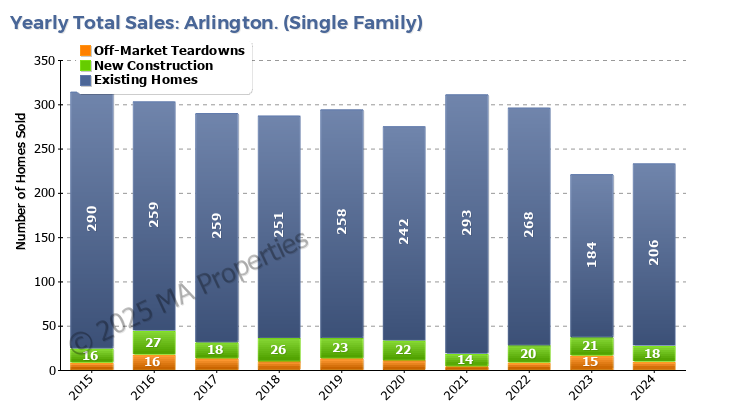

In many respects 2024 was a “rinse and repeat” of 2023. 2024 was impacted by rising mortgage interest rates – this caused sellers to postpone selling and buyers to pull back as they saw rates rise between getting a pre-approval and getting an accepted offer on a home. In some instances, this increase in borrowing costs caused buyers to exit contracts as repayment costs became simply too high.

Looking back at our 2023/2024 Market Review our two key predictions for 2024 were firstly the normal cycle of downsizing, move-up, and relocating sellers will continue with similar number of homes sales as we saw in 2023, and secondly, there is some hesitancy with buyers with mortgage rates still over 6% and uncertainty over the medium-term market condition and price appreciation. This hesitancy will subside as mortgage interest rates decline as the year unfolds.

The continued high interest rates negatively impacted both predictions. The total number of homes sales in 2024 was very similar to 2023 as sellers postponed selling to avoid a large increase in their mortgage monthly repayments. The second prediction hinged on reduced interest rates as 2024 unfolded. Whilst interest rates declined slightly in Q3 they rose again in Q4 and as we write this in January 2025, they are now over 7%.

As we look forward, what will 2025 bring? Mortgage interest rates are predicted to move slightly lower with currently 6.1% predicted for the end of 2025. But we’ve heard this story before and with such uncertainty in the overall economy we anticipate very similar real estate market conditions in 2025 as we saw in 2024. Any sign of more sellers, less hesitant buyers, and the stable market condition seen prior to the COVID years of 2020 and 2021 will have to wait until at least 2026.

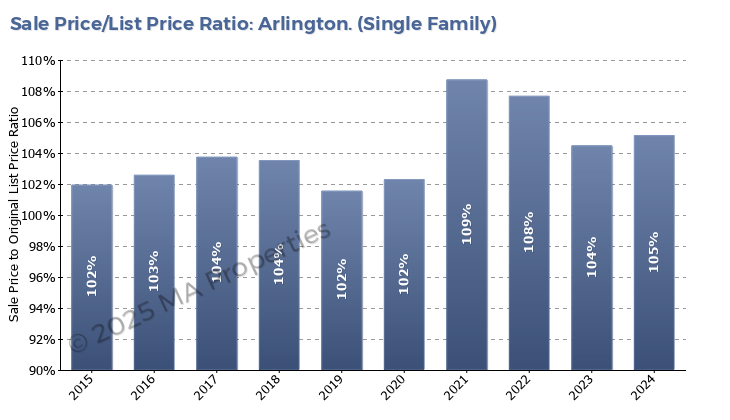

Sellers

It is a more challenging picture for sellers than we have seen in recent years. A decrease in supply usually means that buyers compete for homes creating a strong sellers’ market. But 2024 saw very hesitant buyers in the market because of high interest rates combined with the high price appreciation seen in 2020 and 2021. With high interest rates set to continue throughout 2025 we do not anticipate more sellers entering the market. But, with hesitant buyers to get the maximum price for your home sellers need to focus on the fundamentals when selling – ‘move in’ ready, great staging, a comprehensive marketing strategy (utilizing both digital and traditional channels), and the right pricing strategy to attract the buyers who are looking to buy.

Buyers

While not as strong a sellers’ market as we have seen in prior years, the housing market in Lexington will continue to be challenging for buyers. The market will be characterized by low inventory, similar price levels to 2024, and high mortgage interest rates. So, when the right opportunity arises, buyers must be prepared to act quickly and decisively. It is key to work with an agent who both understands and can educate you on the Lexington market, provide advice on the pros and cons of the home and resale potential of the home, and is able to assist you in structuring a competitive offer.

Homes Sold

Sale Price to List Price Ratio

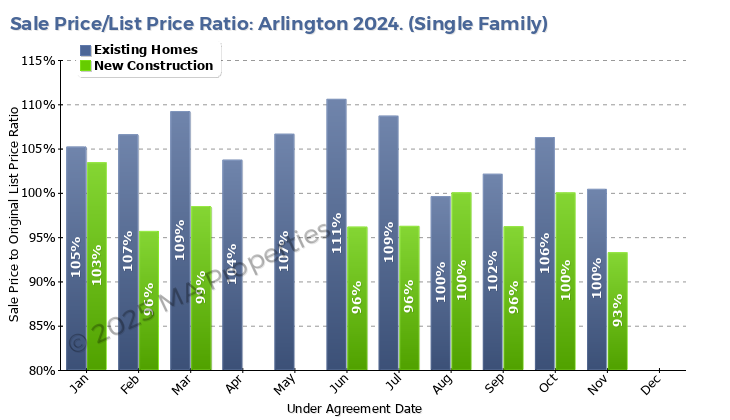

Sale Price to List Price Ratio (Monthly/NC)

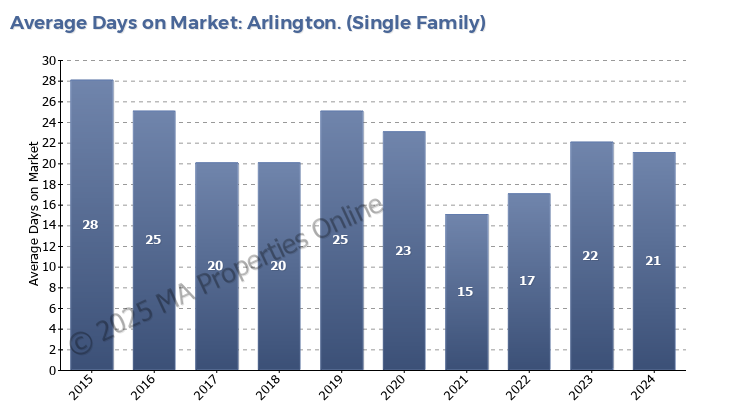

Average Days on Market

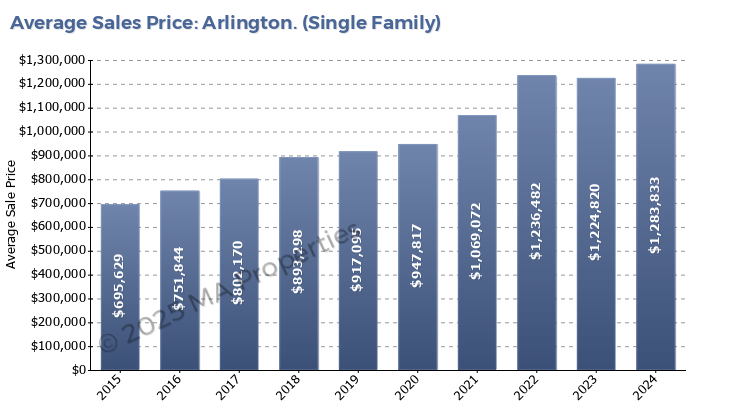

Average Sale Price

Sale Price Analysis